What is Medicare in US Healthcare? How Does Medicare Work?

Understanding the impact of Medicare on healthcare system, and how Medicare in US Healthcare works may seem daunting initially. Yet, through informative research, one can appreciate the positive impact of Medicare on the US. As of September 2023 data, Medicare enrollment stood at 66 million individuals, with 11% receiving assistance due to disability and 89% due to age.

These figures underscore the increasing impact of Medicare on healthcare system, making it one of the best Medicare supplement plans in the US.

Adding to the data, the Federal government allocated $832 billion to Medicare in fiscal year 2023, amounting to 3.1% of GDP. With the aging population and mounting healthcare expenses, Medicare spending is expected to increase. Projections from the Congressional Budget Office indicate that by 2034, Medicare in US Healthcare will reach 4.2% of GDP.

Without delay, let’s dive right into what Medicare is and how it functions to deliver top-notch Medicare benefits for seniors.

What Is Medicare in US Healthcare?

Medicare in US Healthcare is a Federal health insurance program, which is designed for U.S. adults aged 65 and older. Subject to the line, Medicare in US Healthcare also covers individuals with disabilities, such as end-stage renal disease or amyotrophic lateral sclerosis (ALS).

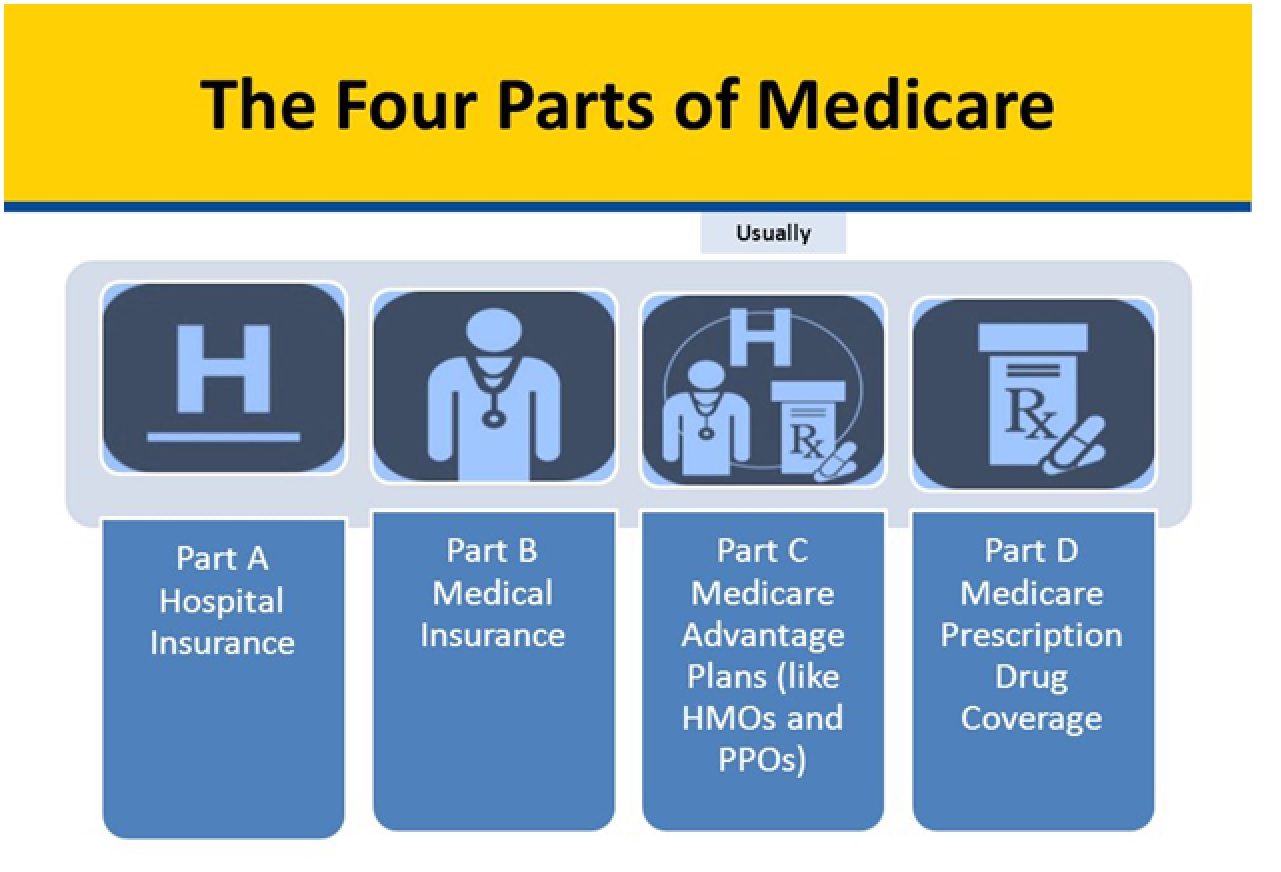

There are 2 ways to enroll in Medicare in US Healthcare and avail of the Medicare benefits for seniors.

1st Way: Original Medicare:

- Part A (Hospital Insurance)

- Part B (Medical Insurance)

2nd Way: Medicare Advantage:

It is also termed Part C and offered by Medicare-approved private insurers.

Additional Plan:

Individuals who need additional coverage can opt for Medicare Part D which is also called the Prescription Drug Coverage.

In addition to the above Medicare benefits schedule, senior citizens who are enrolled under the Part A and Part B schedules have the option to shop for supplemental Medigap. This insurance available from the private insurance payers can bridge coverage disparities by providing extra layers of coverage such as out-of-pocket medical costs.

Now that you know what Medicare stands for, let’s quickly get into the next part and learn how Medicare in US Healthcare works to provide the best Medicare benefits for seniors citizen.

How Does Medicare in US Healthcare Work?

Medicare functions by dividing coverage into two main parts:

- Part A covers hospitalization expenses

- Part B covers medical supplies

While it typically covers most costs, you’re responsible for co-payments and deductibles. Part A usually doesn’t require premiums, but Part B does.

Unlike private health insurance, Medicare doesn’t offer family plans; each person enrolls individually based on eligibility factors such as age or disability.

Once you enroll in Medicare US healthcare, the US beneficiaries have several options, for instance:

- You can stick with Original Medicare without any additional coverage.

- You can also choose Original Medicare and enhance it with Medicare Part D (prescription drug plans) or Medigap (supplemental coverage), depending on your requirements.

- The last option you get is to opt for Medicare Advantage, which replaces Original Medicare and often provides extra Medicare benefits for seniors alongside mandatory coverage. The coverage and benefits you receive are determined by the type of Medicare plan you choose.

To explain to you in a better way, below we have given a gist of how the Medicare US healthcare program works.

For example, upon reaching 65, most US seniors are enrolled in Original Medicare, comprising Part A (often free) and Part B (with a monthly fee deducted from Social Security). Once enrolled, they’re covered for life and don’t need to re-enroll annually. However, people with certain disabilities can qualify after getting Social Security disability benefits for 24 months.

Once citizens are enrolled in Medicare US healthcare plans they begin to get coverage of hospital care (Part A) and outpatient services (Part B) starting on the month of their 65th birthday. The Medicare benefits schedule pays for visits to any approved provider within the plan’s limits, but there are costs like coinsurance and deductibles. This deductible can be covered by the best Medicare supplement plans in the US.

One positive impact of Medicare is that during the Initial Enrollment Period (lasting 7 months around one’s 65th birthday) and yearly during the Annual Enrollment Period, senior citizens can change their coverage, like switching to different plans if they want.

Wrapping Up

Understanding the Medicare benefits schedule, Medicare enrollment decisions and the impact of Medicare on healthcare system is increasingly vital as healthcare costs rise. This knowledge enables you to make informed choices about coverage and related expenses.

Don’t wait to explore your Medicare in US healthcare options and find the coverage that fits your needs. Visit DistilINFO HealthPlan for additional insights and resources on healthcare plans and Medicare. Start learning now to save time!

FAQs

- When is the appropriate time to apply for Medicare?

Ans. Most Americans become eligible for Medicare at the age of 65. The initial enrollment period begins three months before this birthday, which is typically the ideal time to apply. If you’re already receiving Social Security benefits, you’ll be automatically enrolled in both Part A and Part B before turning 65.

- What’s the quickest method to sign up for Medicare?

Ans. The fastest way to enroll in Medicare in US Healthcare is through Social Security, either online or by calling 1-800-772-1213 (1-800-325-0778 for TTY users). Approval for Social Security retirement or disability benefits automatically enrolls you for Medicare Part A with no premium. You’re automatically signed up for Part B, although participation is optional.

- What is the common type of Medicare?

Ans. Plan F is popular among Medicare Supplement plans because it covers more out-of-pocket Medicare costs than any other type of Medigap plan.