Understanding Your Options: A Quick Breakdown of Types of Medicare Plans

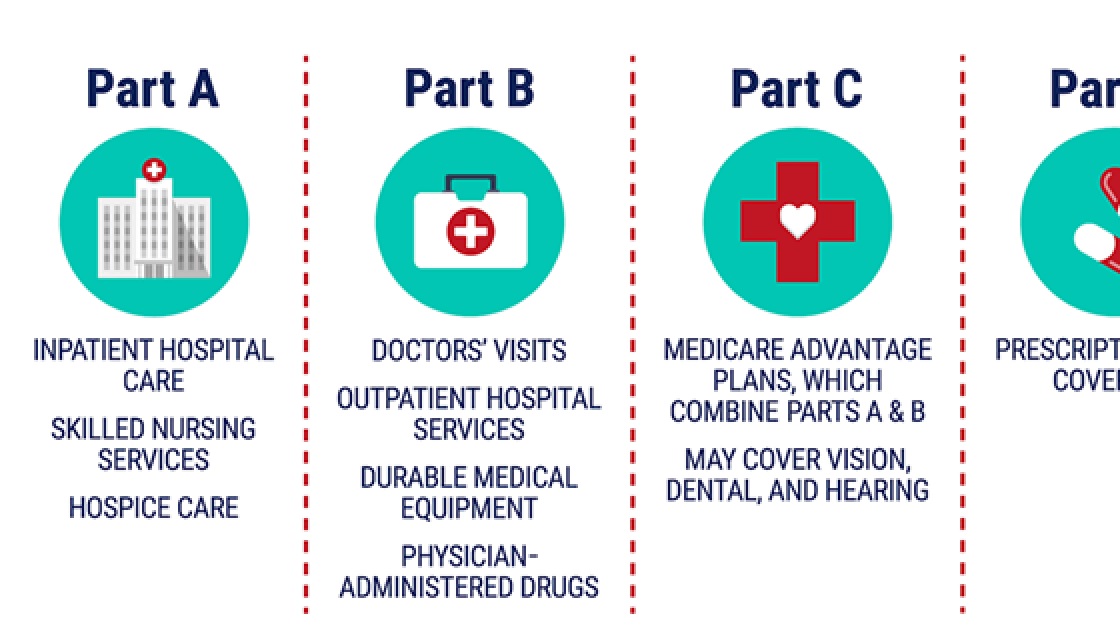

Navigating the intricate landscape of types of Medicare plans in health insurance can feel like mastering the alphabet anew. Amidst the maze of options, understanding the four general parts and each plans offer like A, B, C, and D – and the ten types of Medicare supplement insurance Medigap – A, B, C, D, F, G, K, L, M, and N – can be daunting.

Yet, amidst this complexity, it’s crucial to acquaint oneself. Medicare covers various types of plans, including separate Medicare drug plans, Medicare-approved options, prescription drug coverage plans, and health plans.

Each facet boasts distinct coverage options, costs, covered services, primary care, availability, and regulations. By familiarizing yourself with these nuances, you empower yourself to select the optimal health insurance tailored to your unique needs. Come let us know the types of Medicare plans in healthcare one by one in this quick guide.

Quick Guide To Types of Medicare Plans in Health Insurance

1. Original Medicare (Part A & Part B) Types of Medicare Plans

Original Medicare, comprising Part A and Part B, serves as the foundation of Medicare coverage. It is the first among the types of Medicare plans.

Medicare Part A covers:

- Inpatient hospital stays

- Limited stays in skilled nursing facilities

- Long-term care hospital stays

- Non-long-term or custodial nursing home care

- Hospice care

- Part-time or intermittent home healthcare

Criteria For Full Coverage Under Medicare Part A

The following are the criteria that are required to be met for full coverage by a doctor or hospital under Medicare Part A:

A doctor’s official order stating the need for care

- Facility acceptance of Medicare

- Available days in the benefit period (for skilled nursing facility stays)

- Approval by Medicare and the facility for the stay’s reason

Types of Cost under Part A in 2024:

- No premium for those with 40 quarters of work history and who paid Medicare taxes (up to $505 monthly for <40 quarters).

- $1,632 deductible per benefit period.

- Daily coinsurance: $0 for days 1-60, $408/day for days 61-90, $816/day for days 91+; all costs if hospitalized >90 days and exhausted lifetime reserve days.

Medicare Part B covers:

- Doctors’ visits

- Medically necessary medical supplies and services

- Preventive care services

- Emergency ambulance transportation

- Some medical equipment

- Inpatient and outpatient mental health services

- Some outpatient prescription medications

Criteria For Full Coverage Under Medicare Part B

To ensure coverage under Part B, confirm your doctor or hospital accepts Medicare health plans. Use the Medicare coverage tool for coverage verification.

Types of Cost under Part B in 2024:

- A monthly premium starting at $174.90 (higher for incomes >$103,000/year or $206,000/year for married couples)

- A $240 annual deductible

- 20% coinsurance for Medicare-approved health insurance amounts after meeting the deductible for the year.

Non-Coverage Items under Part A & Part B

Original Medicare doesn’t cover, does not cover certain items and services, such as:

- Long-term care (custodial care)

- Most dental care

- Eye exams for prescription glasses

- Dentures

- Cosmetic surgery

- Massage therapy

- Routine physical exams

- Hearing aids and fitting exams

- Concierge care (retainer-based medicine)

- Items or services from opt-out providers (except for emergencies or urgent needs)

2. Medicare Advantage (Part C)

Medicare Advantage Plans (Part C) are an alternative to original Medicare and are the second among the types of Medicare plans. These health insurance plans are offered by private insurance companies. These health plans combine Parts A, B, and often D, with added benefits like vision and dental coverage.

Key Features of Medicare Advantage Plan part:

- Common types of Medicare Advantage plans include HMOs, PPOs, PFFS plans, and SNPs, operating differently.

- Referrals or pre-authorization by a private company may be required for some services.

- Networks are smaller than Original Medicare health plans, especially in rural areas.

- Insurers can adjust fees annually.

- Enrolling in various types of Medicare Advantage plans prevents concurrent purchase of Medigap coverage.

- These types of Medicare plans offer benefits equal to Parts A and B, with additional services.

- The government pays a fixed amount, while insurers set costs.

- Few types of Medicare Advantage plans cover Part B premiums as well.

Cost under Part C in 2024:

Medicare Part C costs vary by plan type and provider, with the projected average monthly premium for 2024 at $18.50, ranging from $0 to over $400 based on plan selection and location.

3. Prescription Drug Coverage (Part D)

Medicare Part D provides optional Medicare drug coverage for all Medicare beneficiaries, administered through private insurance companies with government contracts. It aims to reduce prescription medication costs, although not all drugs are covered.

Key Features of Medicare Drug Coverage

- In drug coverage part D though enrollment is optional delaying enrollment may result in penalties added to monthly premiums.

- Medicare Drug Coverage is standardized by Medicare health insurance but individual plans can vary in the medications they cover.

- Prescription drug coverage plans typically offer medication coverage through formularies, which list covered drugs with options for each class, and may include generics and tiered programs with different copayment levels.

Cost under Part D in 2024:

The costs of prescription drug coverage plans vary based on plan choice and medication needs, with a projected average monthly premium of $55.50 in 2024, ranging from $0 to over $150.

Final Note

Mastering the details of various types of Medicare plans is essential for informed healthcare choices. Whether you’re looking to join a hospital insurance and part B medical insurance or going forward alternative to original medicare health plans or a prescription drug coverage health insurance, each option offers unique advantages and factors to consider.

For more insights and updates on healthcare plans, keep checking out our blog at DistilINFO HealthPlan. Stay informed and make the most out of your healthcare coverage!

FAQs

- How can I determine my Medicare coverage type?

Ans. You can assess and select the most suitable Medicare coverage option for your area by comparing various plans on Medicare.gov.

- Is Part A, Part B, and Part D automatically included in Original Medicare?

Ans. Part A and Part B are automatically included in Original Medicare upon enrollment. However, to obtain drug coverage, you must opt for and enroll in a Medicare-approved Part D private drug plan.