Medicare Advantage plans are popular Medicare health plans in the healthcare industry. However, there are some pros and cons to Medicare coverage plans.

While some Medicare Advantage plans include long-term savings, plan flexibility, and better care, there are some plans where the covered service options are fewer.

In this quick guide, we’ll explore what Medicare Advantage plans stand for, the pros and cons of Medicare Advantage plans, the types of medicare advantage plans, and more. Be with us till the end and learn how Medicare Advantage plans work by combining part A hospital insurance and part B medical insurance to help you make informed decisions.

What are Medicare Advantage Plans?

Medicare Part C plans, also known as Medicare Advantage, are sold by private insurance companies. They combine original Medicare coverage including Medicare Part A and Medicare Part B and also offer some other additional benefits.

Some Medicare covers the payment of Part B premium, and drug coverage part, and also includes primary care. Most of the common benefits offered by Medicare Advantage plans are:

- Hospitalization coverage

- Limited home healthcare services

- Hospice care benefits

- Doctor’s visit coverage

- Prescription drug coverage benefits

- Preventive care services

- Dental, vision, and hearing coverage

- SilverSneakers fitness memberships

Healthcare Updates on Medicare Advantage Plans

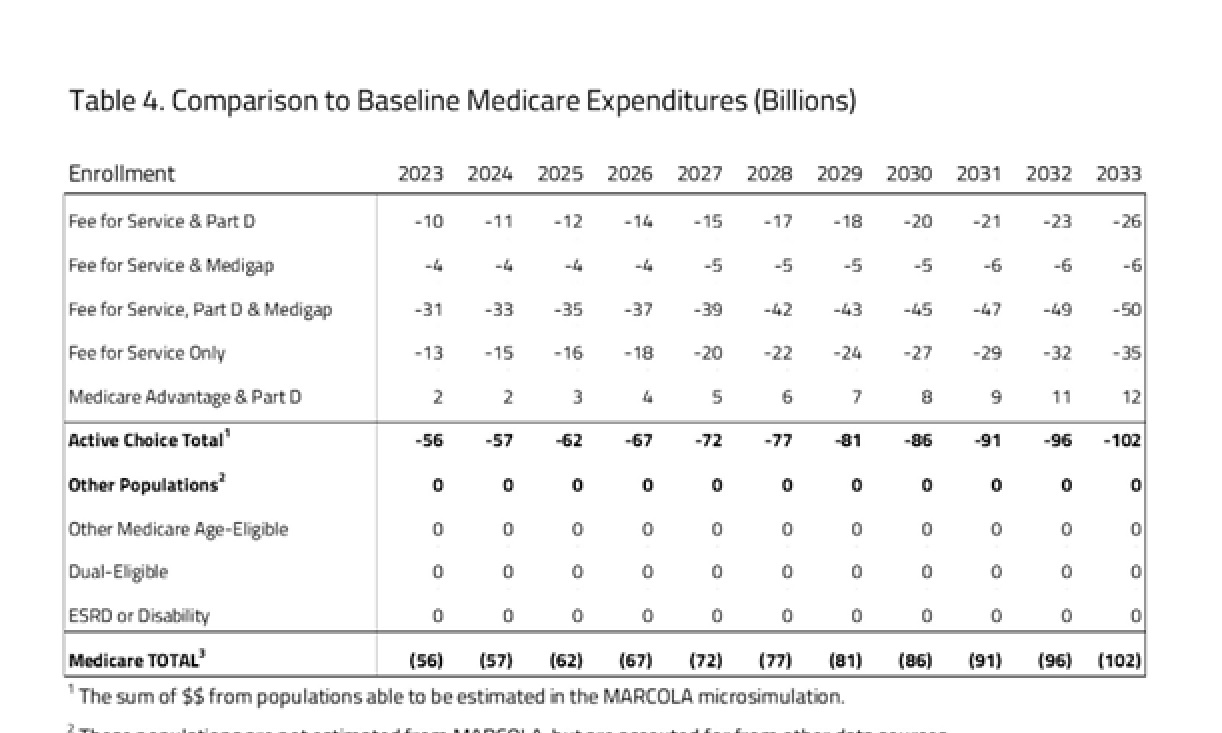

As per The Center for Health and Economy (H&E), the Medicare market is projected to expand steadily, reaching 78 million beneficiaries by 2033.

A notable transition is anticipated from Medicare Fee-for-Service (FFS) to Medicare Advantage, with an estimated increase of 2.7 million by 2025 and 3.0 million by 2033.

Projecting this data shows that knowing the pros and cons of Medicare Advantage plans and how to evaluate the right plan is a necessity. Without delay, quickly get into and know more about Medicare Advantage Plans.

Types of Medicare Advantage Plans

There are different types of Medicare Advantage plans to choose from, including:

- Health Maintenance Organization (HMO): HMO plans to rely on in-network doctors and mandate referrals for specialists.

- Preferred Provider Organization (PPO): PPO plans feature varying rates for in-network versus out-of-network services.

- Private Fee-for-Service (PFFS): PFFS plans to provide flexibility for providers through special payment arrangements.

- Special Needs Plans (SNPs): SNPs assist with chronic condition management and long-term medical expenses.

- Medical Savings Account (MSA): MSA plans combine medical savings accounts with high-deductible health plans.

Now that you got the gist of What Medicare Advantage plans are and the types of Medicare plans look into the Advantages and disadvantages of the Medicare plans.

Perks and Drawbacks of Medicare Advantage Plans

Medicare Advantage plans come with their share of advantages and disadvantages, making them a great fit for some but not for everyone.

- Additional benefits:

Medicare Advantage plans often include extra perks like hearing, dental, and vision coverage, not provided by Original Medicare.

- Cost savings:

Several Medicare Advantage plans often have no monthly premiums, and overall out-of-pocket costs may be less than those of Original Medicare.

- Out-of-pocket limits:

There are caps on how much you’ll pay for hospital and medical services, set by the Centers for Medicare & Medicaid Services, potentially saving you money in the long run.

- Prescription drug coverage:

Most Medicare Advantage plans cover the prescription drug coverage part as their package plans.

- Complete Primary care:

Hospital, medical, and drug benefits are bundled into one plan, offering a streamlined experience compared to Original Medicare.

Drawbacks of Medicare Advantage Plans

- Limited provider options:

Medicare Advantage plans often restrict your choice of healthcare providers to those within their network.

- Travel limitations:

Many plans require you to live and receive non-emergency medical care within their designated service area.

- Reduced flexibility:

Switching back to Original Medicare with a Medicare Supplement Insurance policy may be constrained if you’re enrolled in Medicare Advantage plans.

- Prior authorization requirements:

Some tests or procedures may require approval from your Medicare Advantage plan, potentially causing delays in care.

- Referral mandates:

Unlike Original Medicare, seeing a specialist may necessitate a referral from your primary care physician under Medicare Advantage.

Bonus Tip: How to Choose the Best Medicare Advantage Plans For Yourself?

If you are willing to join a medicare advantage plan, comparing various Medicare Advantage plans is the key to making the right decisions. Firstly, if you are willing to join a medicare advantage plan, you need to understand your healthcare needs and think about what each type of plan offers.

For example, if you have a chronic health condition and prefer continuity of care with a specific provider or facility, opt for Medicare Advantage plans accepted by them. Additionally, if you require prescription drugs, compare plans to find those with lower out-of-pocket costs for medications.

Consider the following questions to aid in evaluating the right Medicare Advantage plans:

- Are referrals required to consult specialists?

- What benefits are provided by each plan? (Including vision or dental, if needed, and their inclusion)

- Are all prescription drugs covered, and what are the associated costs?

- Are your current doctors within the plan’s network?

- What is the Medicare star rating of the plan?

- What are the deductibles, coinsurance, and copays associated with the plan?

- What is the plan’s out-of-pocket maximum?

The Takeaway

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. However, there are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Whether you choose original Medicare or Medicare Advantage, it’s important to review healthcare needs and Medicare options before choosing your coverage. To get health news and medical updates in the healthcare industry and stay updated keep checking DistilINFO HealthPlan and make the right choice for you and your family!

FAQs

- Who is eligible to enroll in Medicare Advantage plans?

Ans. Individuals who have both part A hospital insurance and part B medical insurance and reside in an area where the plan is offered can sign up for a Medicare Advantage plan.

- Which Medicare Advantage plan has the highest acceptance rate?

Ans. UnitedHealthcare Medicare Advantage plans are widely favored, representing 28% of Medicare Advantage enrollments nationwide. Additionally, UnitedHealthcare boasts the largest provider network for Medicare Advantage.